Featured

Table of Contents

- – Not known Details About Required Paperwork for...

- – An Unbiased View of The Pros to Consider of Ba...

- – Little Known Questions About Creating Your Ro...

- – Complimentary Learning Financial counseling f...

- – The Greatest Guide To Policy Changes That Co...

- – Some Of Building Post-Financial counseling f...

Applying for credit card financial obligation mercy is not as basic as requesting your balance be erased. Financial institutions do not easily provide debt mercy, so comprehending how to offer your case effectively can boost your possibilities.

I wish to go over any type of choices available for reducing or settling my debt." Financial debt forgiveness is not an automatic option; oftentimes, you need to discuss with your creditors to have a part of your equilibrium reduced. Charge card business are frequently open to settlements or partial mercy if they think it is their best opportunity to recoup several of the cash owed.

Not known Details About Required Paperwork for Financial counseling for veterans in Arizona coping with high summer costs and rising bills

If they supply complete forgiveness, obtain the agreement in composing before you approve. You could need to send a formal written demand discussing your hardship and just how much mercy you require and offer paperwork (see next area). To negotiate properly, try to recognize the lenders position and use that to offer a solid case as to why they need to deal with you.

Always ensure you get confirmation of any mercy, settlement, or difficulty strategy in writing. Lenders may offer much less relief than you require.

The longer you wait, the more charges and passion accumulate, making it harder to certify. Financial debt mercy entails legal considerations that debtors ought to know before continuing. Consumer security laws control how lenders manage forgiveness and settlement. The adhering to government legislations assist shield customers seeking financial debt mercy: Prohibits harassment and violent financial debt collection methods.

An Unbiased View of The Pros to Consider of Bankruptcy

Requires creditors to. Makes certain fair methods in borrowing and settlement negotiations. Limitations costs and avoids unexpected rates of interest hikes. Needs clear disclosure of repayment terms. Restricts financial obligation settlement firms from billing upfront fees. Needs firms to reveal success rates and potential dangers. Understanding these securities helps avoid rip-offs and unreasonable creditor practices.

This moment structure differs by state, normally between 3 and 10 years. Once the statute of limitations runs out, they normally can't sue you any longer. Nonetheless, making a repayment or perhaps acknowledging the debt can reactivate this clock. Also if a creditor "fees off" or composes off a debt, it does not mean the financial debt is forgiven.

Little Known Questions About Creating Your Route to Relief.

Prior to accepting any layaway plan, it's a good concept to check the statute of restrictions in your state. Lawful implications of having financial obligation forgivenWhile debt forgiveness can eliminate economic problem, it includes possible legal consequences: The internal revenue service deals with forgiven financial debt over $600 as gross income. Consumers receive a 1099-C kind and needs to report the quantity when filing tax obligations.

Right here are several of the exceptions and exemptions: If you were bankrupt (suggesting your total financial debts were higher than your complete possessions) at the time of mercy, you may exclude some or all of the terminated debt from your gross income. You will require to submit Form 982 and attach it to your income tax return.

While not connected to charge card, some trainee finance mercy programs permit debts to be terminated without tax obligation consequences. If the forgiven financial obligation was associated to a certified farm or service procedure, there might be tax exclusions. If you don't receive debt forgiveness, there are different financial debt alleviation approaches that might benefit your situation.

Complimentary Learning Financial counseling for veterans in Arizona coping with high summer costs and rising bills Resources for Consumers Things To Know Before You Buy

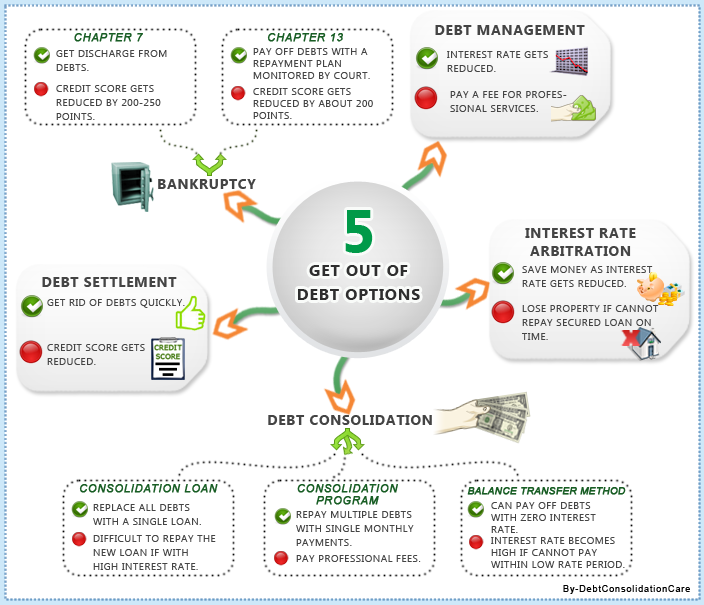

You make an application for a brand-new financing large sufficient to pay off all your existing bank card equilibriums. If approved, you make use of the brand-new financing to settle your credit report cards, leaving you with simply one month-to-month settlement on the combination financing. This simplifies financial obligation monitoring and can save you cash on rate of interest.

Most importantly, the agency negotiates with your lenders to decrease your interest prices, significantly lowering your general financial debt problem. They are a wonderful financial debt remedy for those with bad credit history.

Let's encounter it, after numerous years of higher rates, money doesn't reach it used to. Concerning 67% of Americans say they're living income to paycheck, according to a 2025 PNC Bank research, which makes it hard to pay for financial obligation. That's specifically real if you're carrying a large financial debt equilibrium.

The Greatest Guide To Policy Changes That Could Transform Financial counseling for veterans in Arizona coping with high summer costs and rising bills Procedures

Debt consolidation loans, financial debt monitoring strategies and settlement methods are some techniques you can use to minimize your financial obligation. Yet if you're experiencing a significant monetary hardship and you have actually worn down other alternatives, you might have a look at debt forgiveness. Financial obligation forgiveness is when a lender forgives all or some of your impressive equilibrium on a lending or various other charge account to help eliminate your financial obligation.

Financial debt mercy is when a loan provider agrees to clean out some or all of your account equilibrium. It's an approach some people utilize to decrease debts such as debt cards, personal finances and student finances.

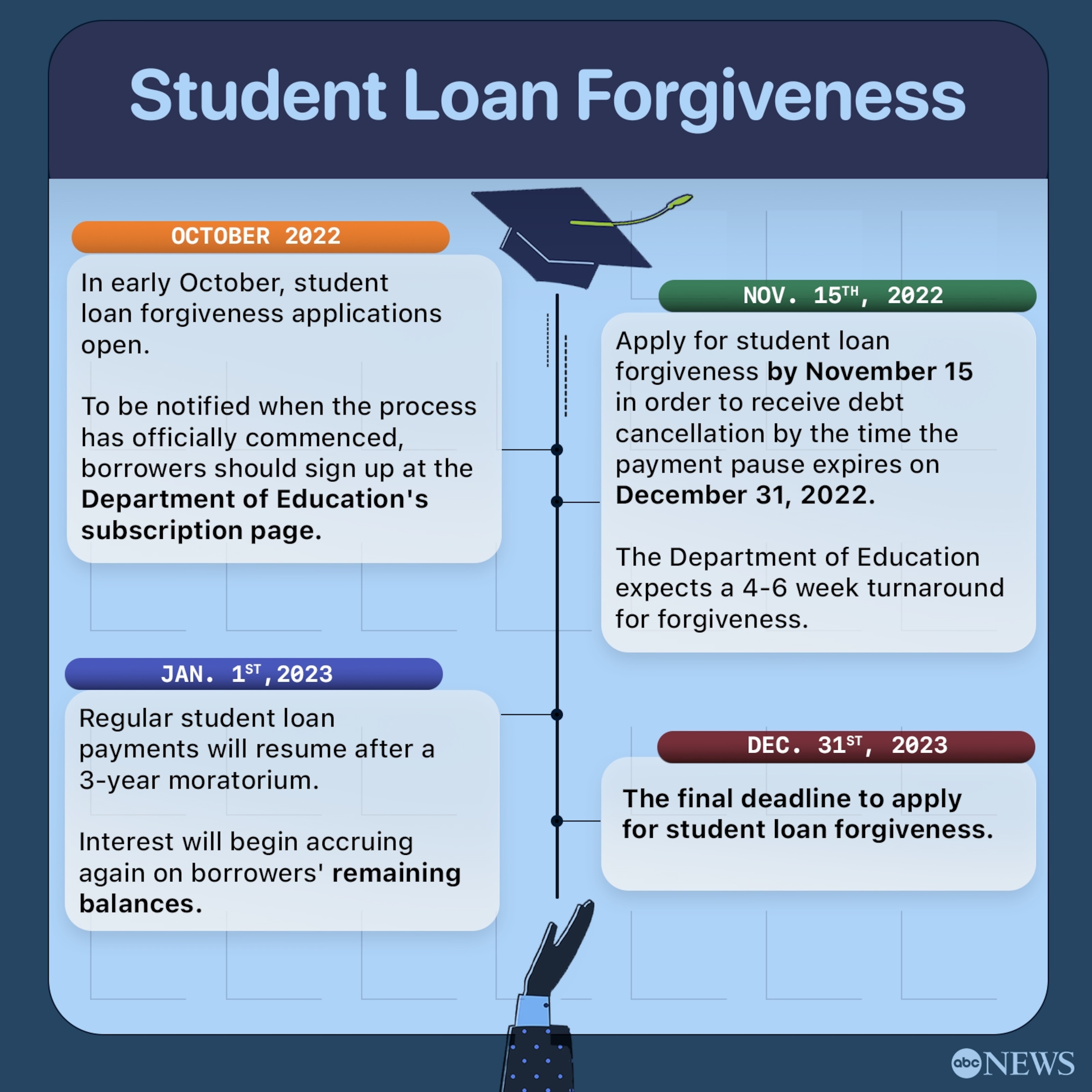

The most popular option is Public Service Finance Forgiveness (PSLF), which wipes out continuing to be government loan balances after you function complete time for an eligible company and make repayments for 10 years.

Some Of Building Post-Financial counseling for veterans in Arizona coping with high summer costs and rising bills Budget for Long-Term Stability

That means any type of not-for-profit medical facility you owe may have the ability to offer you with financial debt alleviation. Even more than half of all united state medical facilities offer some type of medical financial debt relief, according to client solutions advocate team Dollar For, not simply nonprofit ones. These programs, commonly called charity care, minimize and even remove medical expenses for competent clients.

Table of Contents

- – Not known Details About Required Paperwork for...

- – An Unbiased View of The Pros to Consider of Ba...

- – Little Known Questions About Creating Your Ro...

- – Complimentary Learning Financial counseling f...

- – The Greatest Guide To Policy Changes That Co...

- – Some Of Building Post-Financial counseling f...

Latest Posts

Not known Details About Does Bankruptcy Make Sense for Your Case

Market Changes for When Bankruptcy Counseling Suggests Debt Management or Forgiveness Instead and Debtor Options Fundamentals Explained

What Does Community-Based Financial counseling for veterans in Arizona coping with high summer costs and rising bills Programs Explained Do?

More

Latest Posts

Not known Details About Does Bankruptcy Make Sense for Your Case